Strategic tax shifts are underway in low-tax jurisdictions as countries like Cyprus and Mauritius respond to the Organization for Economic Co-operation and Development (OECD)’s Pillar Two global minimum tax framework. These reforms are more than just technical updates. They reflect a major shift in how countries position themselves and meet international tax standards in a fast-changing global environment.

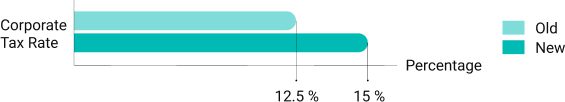

Cyprus: A Uniform Corporate Tax Rate

Cyprus has announced an increase in its corporate tax rate from 12.5% to 15%. This is a direct response to the OECD’s Pillar Two global minimum tax framework, which mandates a 15% effective tax rate for large multinational enterprises (MNEs). By applying the 15% rate across the board, Cyprus simplifies compliance and, crucially, ensures that any top-up taxes are collected locally. This prevents other jurisdictions from imposing the tax under the Income Inclusion Rule (IIR) or Undertaxed Profits Rule (UTPR).

IIR

The IIR is the primary rule in Pillar Two. It allows the parent company’s country to collect a “top-up tax” if any of its foreign subsidiaries pay less than the 15% minimum effective tax rate.

UTPR

The UTPR is a secondary rule that kicks in only if the IIR does not apply. (e.g. if the parent company is in a country that has not adopted the IIR). In that case, other countries where the group operates (i.e. at the subsidiary level) can collect the missing tax by denying deductions or making other adjustments.

Mauritius: Introducing the QDMTT

Similarly, Mauritius is adapting by introducing a Qualified Domestic Minimum Top-up Tax (QDMTT), effective from July 1, 2025. This legislation applies to resident entities of MNE groups with annual consolidated revenue over €750 million in at least two of the last four fiscal years. The QDMTT ensures that any Mauritian-based companies within these groups with an effective tax rate below 15% will pay the top-up tax to the Mauritian government, instead of other jurisdictions that have applied the IIR or UTPR.

Implications for Multinational Enterprises

These developments underscore the growing complexity of international tax compliance. MNEs operating in or through low-tax jurisdictions must now:

- Monitor effective tax rates across all jurisdictions.

- Reassess intercompany arrangements and tax structures.

- Ensure documentation and transparency meet OECD expectations.

The introduction of domestic top-up taxes such as the QDMTT also highlights the need for MNEs to evaluate the local tax impact of global reforms, particularly in jurisdictions where they previously benefited from preferential regimes.

Opportunities for Mauritius

Developing countries like Mauritius face the ongoing challenge of preserving their tax base while ensuring they remain a competitive and attractive destination for investors. With the global minimum tax set at 15%, Mauritius now competes on equal terms with other jurisdictions. This presents an opportunity for Mauritius to sharpen it s attractiveness to the global investor club with a focus on strengthening economic substance, streamlining regulations, investing in skilled talent, and promoting our strategic location as a gateway to Africa and Asia