Prior to the amendments brought by the Finance Act 2018, foreign source income included income derived by a Category 1 Global Business Licence company from its transactions with non-residents or corporations holding a Global Business Licence under the Financial Services Act.

Following the amendments brought by the Finance Act 2018, effective from 1 January 2019, the definition of foreign source income was revised to exclude income flows between Global Business Licence (“GBL”) companies. The term now refers to “income which is not derived from Mauritius”.

According to the Income Tax Act 1995,” interest payable by any person, other than a bank or a non-bank deposit taking institution under the Banking Act, to any person, other than a company resident in Mauritius” is subject to withholding tax, also known as Tax Deducted at Source (“TDS”), at a rate of 15%.

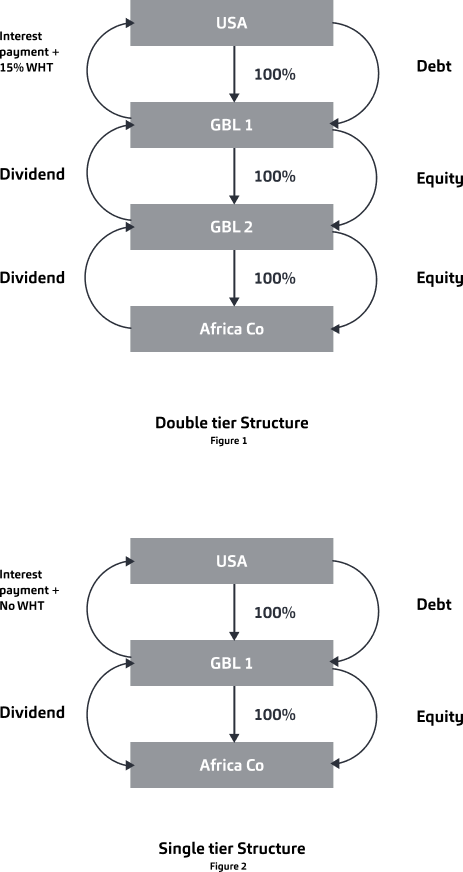

An exemption applies when interest is paid by a GBL company to a non-resident who does not carry on any business in Mauritius, provided the payment of the interest is made from foreign source income. In such cases, the interest is exempt from corporate tax in Mauritius.

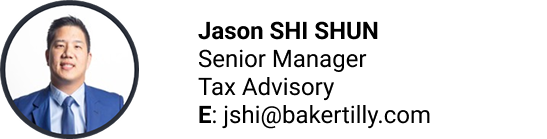

Where the payment of interest by a GBL to a non-resident is made from income earned from another GBL, as illustrated by the multi-layered structure below, the interest payment will not benefit from the exemption from withholding (“WHT”), as the interest is being paid from local source income according to the updated definition of foreign source income.

For more information on how Baker Tilly can assist in reviewing your structure and mitigate any tax leakage, please talk to us.